A Look At The Inland Northwest....

Every year, I get several inquires about properties that would possibly sell as a rent-to-own. For many of these buyers, they are looking for a more personal connection than they might have from a big mortgage company. Or perhaps they can’t qualify for a typical mortgage because their credit score isn’t the best, or some of their income is under-the-table.

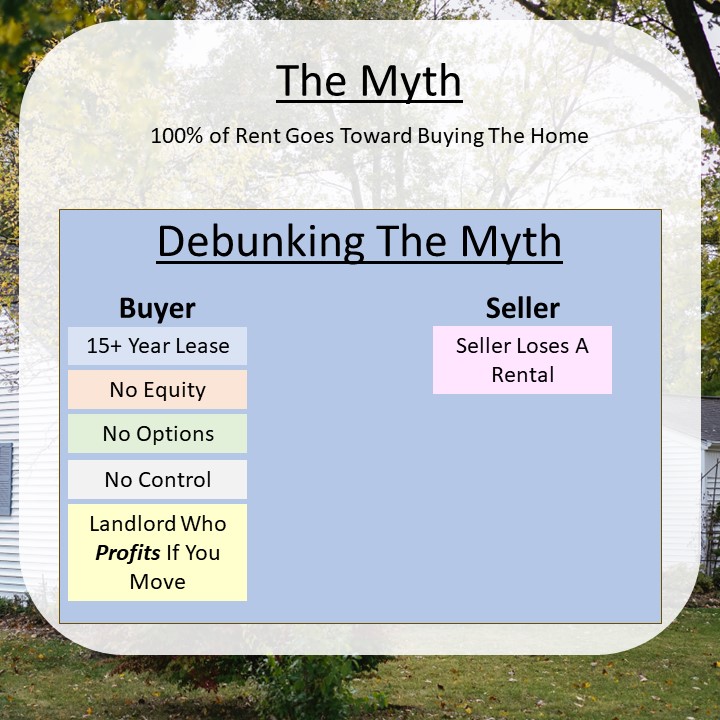

In the quest for a perfect financing option, many of those searching for rent-to-own, are looking specifically for a perfect option where 100% of every rent check goes toward owning the rental home. Ideally, they would rent for a few years, and then the landlord would sign over the lease once the home is paid off. Wouldn’t that be amazing?

Unfortunately, It can’t work that way. When you start looking at the logistics, it isn’t as perfect as it looks at first glance.

Let me show you what I mean… Say for a moment that you’re the landlord property owner. You own a house and you want to rent it out for extra income. You have 2 sets of tenants choose from: regular tenants, and rent-to-own tenants. Which would you choose? If you choose regular tenants, the property will continue to be an investment for the rest of your life that you can pass down to your children. If you choose the rent-to-own tenants, you will give the home away in a few years. You collect no interest, make virtually no profit, and then you have to come up with the money yourself to buy a new investment property. From a landlord’s point-of-view, it is not a good business move.

Now, let’s look at this model of rent-to-own from the tenant’s perspective. Assuming the tenant found an owner who would give a property to them at the end of the lease – consider how LONG that lease would have to be to make up the value of the house! A minimum of 15 – 30 years. That would be 15-30 years in the same house, without moving. It’s not like a mortgage where you build equity. It’s technically a rental until the very end – the deed of the home would remain in the name of the landlord until the end. So the landlord has control over the lease until that last check is paid.

, so in this hypothetical situation, if the tenants move before it’s paid off, the lose it all. Yikes.

Finally, put those together – A tenant who loses the house if they move, and a landlord who loses the house if the tenants stay until the end.

Imagine the friction. It’s like a round of Survivor – with a several hundred-thousand dollar house on the line.

Ultimately, this particular model would make a miserable situation for both parties. That is why rent-to-own contracts are virtually always used as a short-term solution.

Let’s take a look at the 2 rent-to-own models that are most commonly in use in the real estate world today: LEASE OPTION or LEASE PURCHASE.

The difference between the two is in the way that the landlord is paid for reserving the home for the tenant.

In LEASE OPTION, the tenant purchases the “option” to purchase the home when the lease is up. This is generally arranged at the start of the lease and is a percentage of the home’s value. The “option to purchase” is generally non-refundable, and does not go toward the purchase of the home.

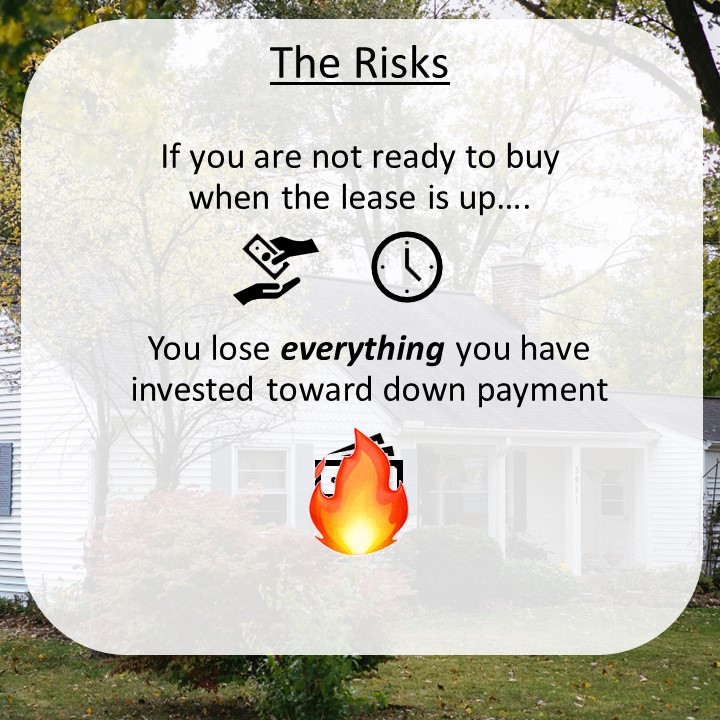

In a LEASE PURCHASE, the tenants pay additional money each month, above and beyond the rent, that will go toward the home’s down payment. Ideally, by the time the lease is up, the tenants will have paid enough extra that those funds will cover the down payment on their mortgage. This extra $200 – $400 (or more, depending on the value of the house), is non-refundable if the tenants do not (or cannot) buy the home at the end of the lease.

In both of these options, the lease term is 1-3 years, and the buyer is expected to purchase the home using a traditional mortgage when the lease is up..

Because every rent-to-own deal is custom to the specific land owner and tenant, sometimes the terms can be a combination of both models, or a little different altogether.

So, obviously, there are some risks here – In short, if you are unable to get a mortgage or purchase the home for any reason – you lose all of the extra money you have invested.

That is a lot of pressure. What if life takes an unexpected turn and it impacts your credit, or what if, 2 years down the road, you find a less expensive home that you like better?

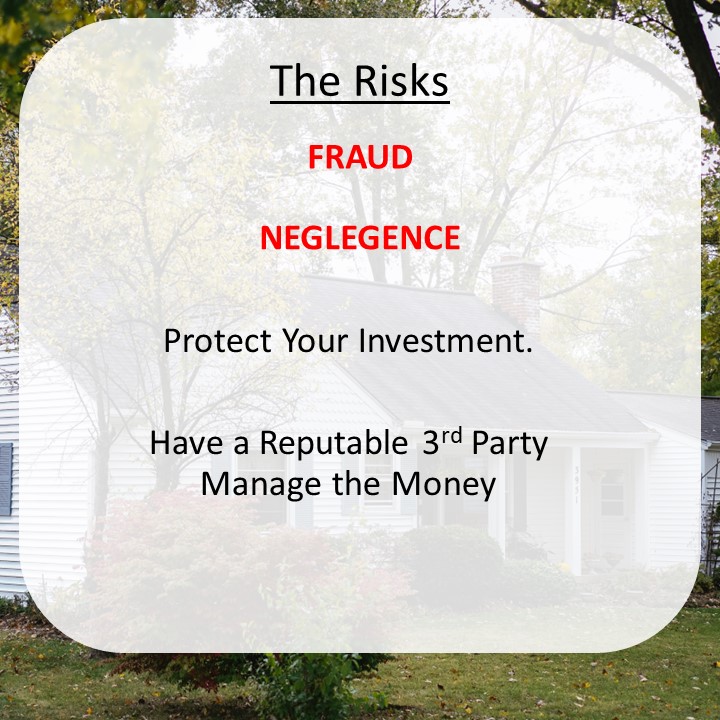

Both options leave lots of room for potential fraud – particularly against the tenants, so it is very important for those considering this type of purchase, to involve a professional 3rd party – an attorney, long term escrow company, or other group to monitor payments and ensure that everything goes smoothly.

Both options also leave room for potential fraud – particularly against the tenants. Always be wary of any seller/landlord who refuses to allow a neutral 3rd party (like an attorney or long term escrow company) to manage the funds and records. It is too easy for a seller to lose the payment records, or… consider this… what if the seller, God forbid, dies in a car accident and his heirs don’t want to honor the agreement? Then you’re stuck between a rock and a hard place.

You will also want to involve a title company to ensure that the person you are dealing is not a scammer and actually owns the property.

I also strongly suggest having your attorney review the contract before you sign. The deck will already be stacked in the landlord’s favor. You want to be positive that the landlord isn’t leaving loopholes that would allow him to take advantage of the situation.

So let’s go back to the real options: For Rent-to-own, you have the LEASE OPTION where you pay a large deposit up front and buy the home when the lease is up, and LEASE PURCHASE, where you pay rent plus extra that goes toward the down payment so that you have some stored away and you buy the home when the lease is up.

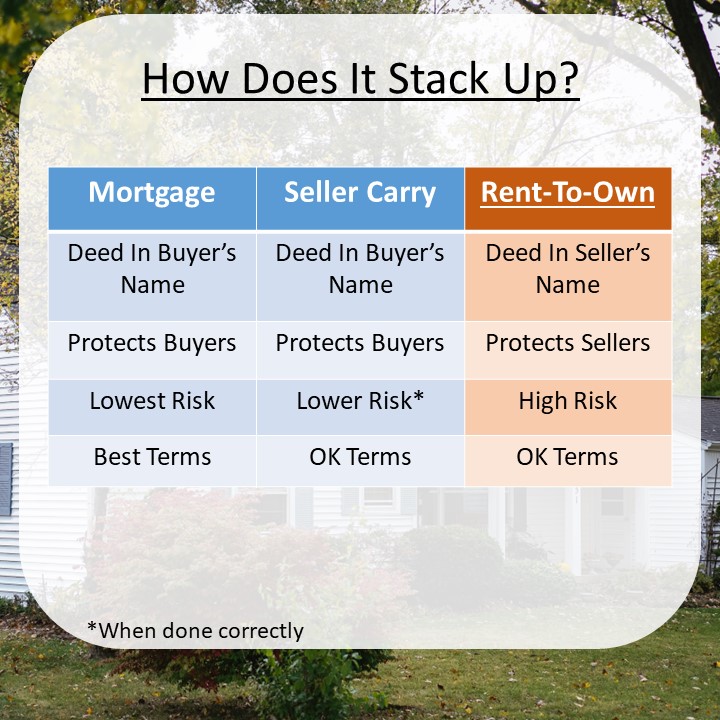

My preference, and what I almost always advise my buyers, is to look at other options before committing to rent-to-own – Options that will get the title of the house into your name as quickly as possible, and take control out of the seller’s hands and put it into your hands.