A Look At Seller Carried Contracts

A seller carried contract is something I see more often with vacant land, but it can be used for residential and commercial properties as well.

In a seller carry, the seller also acts as the lender for a given amount of time. The seller accepts your mortgage payments and applies them to the balance owed on the home.

Every Seller Carry contract is unique to the individual seller. Here’s why that’s important – Every seller has different contract terms that they will accept. Some will work with a down payment of 20%. Others want 75% down. Some will charge 9% interest. Others will charge 12%. Some will carry for 1 year – others for as long as 10 years. There is tremendous variation. So, If you come to me and say, “I would like to purchase some land with a seller carry.” My next step is to learn more about what you need in a seller carry contract, and then to find sellers who offer similar terms. It is definitely a more complex process.

I usually do several of these in a year, and here is what I normally see –

Down Payment amount, can vary quite a bit depending on what the seller needs the funds for. If the seller doesn’t urgently need cash for a project, the down payment can be as low as 15% (enough to cover closing costs and some property taxes owed). If the seller is selling the property so that they have money for their next investment project, the down payment will be higher – 50% down is not unusual, and it can go as high as 75% down.

Sellers usually agree to carry the contract for 2-7 years, with 2 or 3 years being the most common that I see in this area. During that time, you would make mortgage payments to the seller, then refinance the balance into a more traditional land loan or mortgage before the term is up.

- Sellers normally charge an interest rate that is 3-5% higher than the going mortgage rate that a big lender would provide. Seller lenders are a much smaller operation, and it’s generally not feasible for them to operate for the same price as the big companies. It takes more interest to make it worth their time and work.

- Most sellers in a seller carry contract will check your credit score, and will require you to have at least the same minimum scores as a commercial lender – so 580 – 650, although some sellers want closer to a 700.

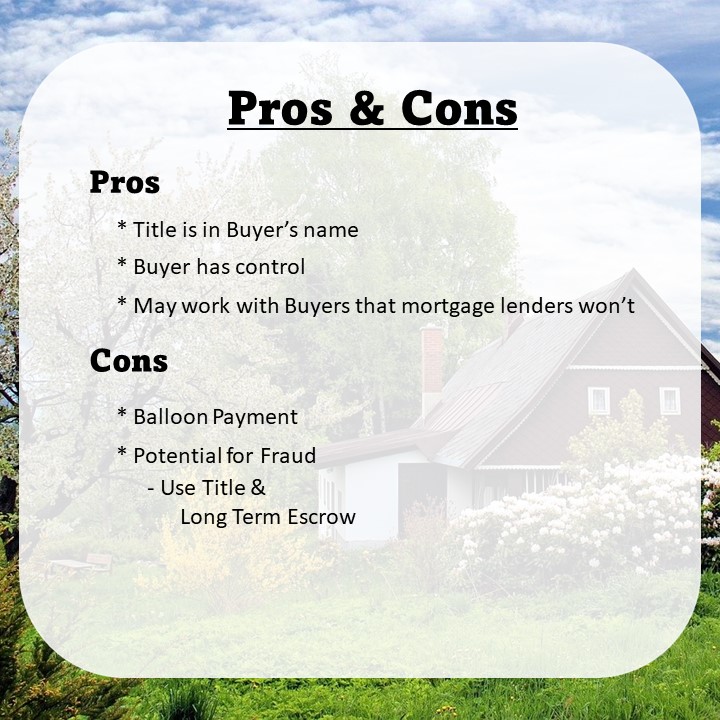

Pros & Cons

So, Here’s what seller carry has going for it:

The deed is recorded in the buyer’s name at closing – so as long as you make the payments, the seller can’t interfere.

The buyer also normally has control over the property, so unless it is specified otherwise in your contract, you have the freedom to paint the walls, renovate, and landscape.

Finally, some sellers may work with buyers who don’t qualify for a traditional mortgage. Now, this can be misleading. Most seller’s won’t work with folks who have bankruptcies, foreclosures, or poor credit. However, sellers may work with buyers who get paid under-the-table, or buyers who are buying vacant land and intending to build within the year.

Now, here is the downside:

*Balloon payment: Most sellers will only carry for 2-5 years, so unless you are making massive payments, you will still owe a balance when the seller carry contract is up. That balance is a balloon payment and needs to be paid all at once. For most buyers, that means you must plan to refinance the loan with a normal lender before the contract ends. The regular lender pays off the balance, and you resume making payments with the new mortgage company.

*Next, there is some potential for fraud. There is a con going around where a “seller” offers their home for sale on a seller contract, the buyers bring the large down payment, and they all agree to save money by leaving the title and escrow companies out of the loop. Then, a few months later, it comes out that the “Seller” never really owned the house to begin with. She was a tenant running a scam. The real property owners show up to find out why rent hasn’t been paid, and they find a nice family living in the home completely unaware that they’ve been scammed. There is a safe way to complete a seller carry, but buyers have to make sure to do their homework, and protect themselves.

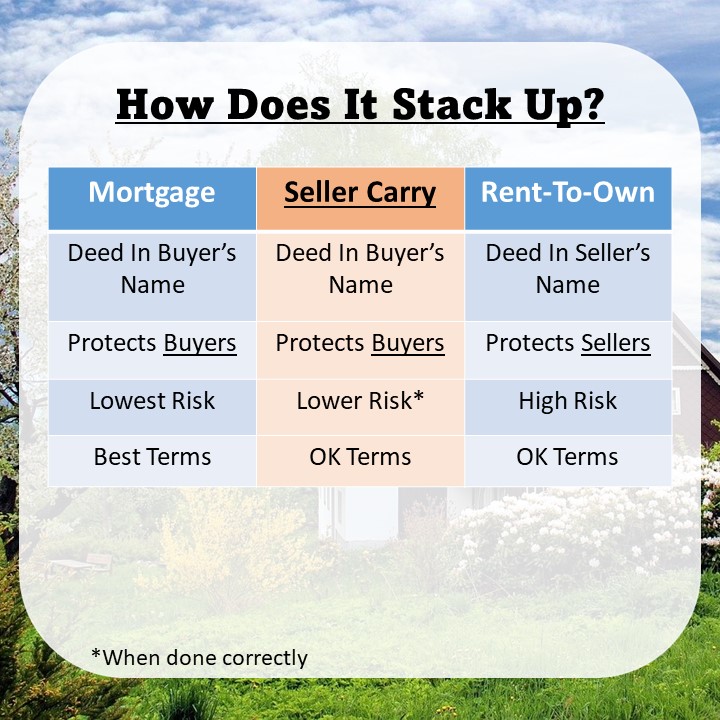

Finally, Let’s take a look at how Seller Carried Contracts stack up against the other loan types: traditional mortgages, and rent-to-own

Like a traditional mortgage, the deed goes into the Buyer’s name early on, and the contracts are designed to protect buyers. Rent-to-own contracts are designed to significantly benefit the Sellers.

In terms of Risk level, Seller carry is middle of the road, when it’s correctly set up, and rent-to-own is the highest risk for buyers.

For terms and term length, the traditional mortgage is easily superior. Seller Carry and Rent-to-Own have the shorter terms, higher interest, and more restrictions – however, sometimes, there are circumstances that make one of these options a useful alternative.

If you have questions about what loan type would work for you, please call, text, or email! I look forward to answering your questions.